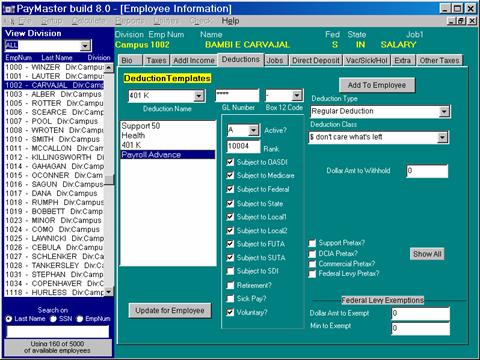

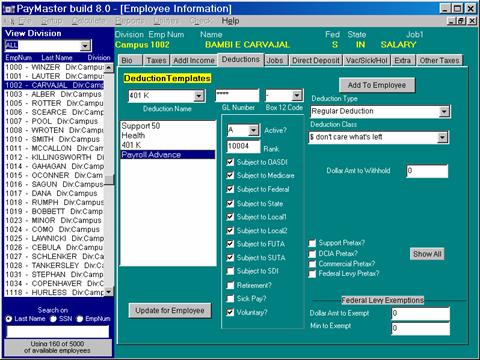

In this section you can assign deduction templates. PayMaster already includes preconfigured deductions which are also listed in order of priority in general. (there are always exceptions) These deductions have assigned the most common attributes for that particular deduction.

You can add more templates for your company under the "Setup" > "Company" > "Deductions" screen previously. In this section, you can further edit the deductions on the employee level.

To add a deduction, from the  drop down, select deduction (ex.

Support65). Then click on

drop down, select deduction (ex.

Support65). Then click on ![]() . Next, with the "Support65"

highlighted, modify the deduction as applicable. Make sure "A" for

active is selected.

. Next, with the "Support65"

highlighted, modify the deduction as applicable. Make sure "A" for

active is selected. ![]() For information on Box 12 codes and other

choices, see the appendix. Next, enter the Rank, Deduction Type,

and Deduction Class.

For information on Box 12 codes and other

choices, see the appendix. Next, enter the Rank, Deduction Type,

and Deduction Class.

Rank

This value is assigned to a deduction to mark the order of deduction to be taken first. The software assigns this number and should not be changed.

Deduction Type

Select only one of the below deduction types:

Regular Deduction

Pretax Deduction

Deductions taken before taxes (depreciated: use regular deduction instead)

Child Support

DCIA

Debt Collection Improvement Act – Under the Federal Debt Collection Improvement Act of 1996, any executive, judicial, or legislative agency that administers a program that loans money to individuals may garnishee the wages of the individual to collect on the debt, if the individual fails to repay the debt according to an agreement with the agency. These administrative wage garnishments (AWGs) specifically relate to non-tax debts (tax levies are under the exclusive jurisdiction of the IRS).

Commercial Garnishment

Student Loan

Deduction Class: This is method by which you withhold deductions.

· Straight Percentage to Max – deduct a fixed percentage of net pay up to a maximum amount

· Straight Dollar Amount to Max – deduct a fixed dollar amount of net pay up to a maximum amount

· $ leave 30X min wage – deduct fixed dollar amount but leave employee with at least 30 times minimum wage

· % leave 30X min wage – deduct percentage but leave employee with at least 30 times minimum wage

· % >25 don't care what's left – deduct percentage regardless of what is left

· $ don't care what's left – Most commonly used – deduct fixed dollar amount regardless of what is left

· small $ amt per hr – deduct a small fixed amount per unit worked (e.g. less than a dollar)

· lesser amt $ OR % - deduct either a fixed dollar amount or a percentage, which ever is smaller

· Straight Percentage of Gross – deduct a fixed percentage of gross pay

· Straight Percentage of Gross with Max – deduct a fixed percentage of gross pay up to a maximum amount

· Advance % – deduct a percentage up to a maximum amount, can cross tax year boundaries

· Advance $ – deduct a fixed amount up to a maximum amount, can cross tax year boundaries

Depending on which Deduction Class is chosen, you will prompted to enter either:

· Dollar Amt to Withhold

· Percent to Withhold

· Max to Withhold

· Amount Per Hour

Max Period: If you are using a deduction that has a max this option will appear.

· Pay Period

· Monthly

· Yearly

· None (depreciated)

Federal Levy Exemptions

These values must be used in conjunction with Federal Levy to exempt part of employee’s wages from being garnished. Consult the actual court order for the actual values. Usually 30X or 40X the federal minimums wage.

· Dollar Amount to Exempt

· Min to Exempt

To save modifications click on![]() . To delete a deduction, just right

click the selection and select "delete".

. To delete a deduction, just right

click the selection and select "delete".

Note: You can only delete a deduction that has not been used before. Once a deduction has been taken you cannot delete it. If you do not want it to be taken anymore just make the deduction Inactive or make the dollar amount to withhold zero.

See the section titled Setup/Company/Deductions for more details.

Related Topics