Division

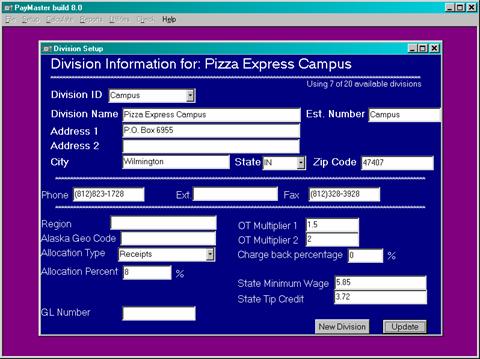

Go to Setup/Division/Division

- Enter the basic information for your division. Click

"New Division" to save your data. Click “Update” to save any

changes to existing divisions. Add more divisions if applicable.

- Est. Number/Region/Alaska Geo Code: Further identification

of your division for state reporting purposes.

- State Minimum Wage and State Tip Credit: In processing

payroll, PayMaster uses the state minimum wage and tip credit.

Generally, it should take which ever is highest, the Federal or State.

- You must allocate tips among

employees who receive them if the total tips reported to you during any

payroll period are less than 8% (or the approved lower rate) of this

establishment's gross receipts for that period.

- Generally, the amount

allocated is the difference between the total tips reported by employees

and 8% (or the lower rate) of the gross receipts, other than non-allocable

receipts.

- Lower rate. You (or a majority

of the employees) may request a lower rate (but not lower than 2%) by

submitting an application to:

Internal Revenue

Service

National Tip

Reporting Compliance

678 Front Avenue NW,

Suite 200

Grand Rapids, MI 49504-5335

or visit

http://www.irs.gov/instructions/i8027/ch01.html

- The burden of supplying

sufficient information to allow the IRS to estimate with reasonable

accuracy the actual tip rate of the establishment rests with the

petitioner. Your petition for a lower rate must clearly demonstrate that a

rate less than 8% should apply.

- A majority of all the directly

tipped employees must consent to any petition written by an employee. A

“majority of employees” means more than half of all directly tipped

employees employed by the establishment at the time the petition is filed.

Employee groups must follow the procedures in Regulations section

31.6053-3(h); Pub. 531, Reporting Tip Income; and Rev. Proc. 86-21. The

IRS will notify you when and for how long the reduced rate is effective.

- OT Multiplier 1, 2: Used to

calculate over time rates. Default 1.5 and 2.

- Charge Back Percentage: Where tips are charged on a credit

card and the employer must pay the credit card company a percentage on

each sale, then the employer may pay the employee the tip, less that

percentage. This charge on the tip may not reduce the employee's wage

below the required minimum wage.

Related Topics

Division

Copyright (c) 2008 PayMaster Pro LLC, All Rights Reserved.