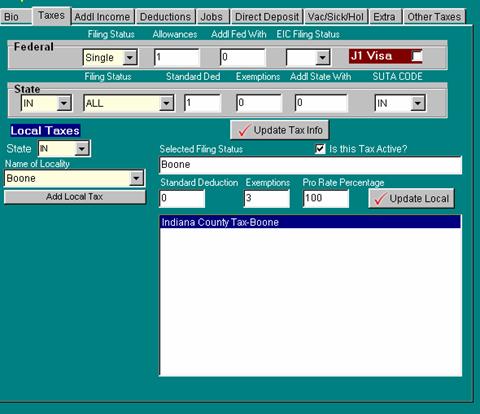

Enter local tax information if applicable. If the state selected

for the employee’s state filing status requires that information, PayMaster will

show the entry screen. First, select the State, then select the "Name of

Locality" (ex. Boone), press ![]() and the locality will show in the "Selected

Filing Status" box. Highlight it, making sure it is active. Edit the

"Standard Deduction", "Exemptions" and "Pro Rate

Percentage" if applicable,

and the locality will show in the "Selected

Filing Status" box. Highlight it, making sure it is active. Edit the

"Standard Deduction", "Exemptions" and "Pro Rate

Percentage" if applicable, ![]() to save information.

to save information.

State: Only Certain States have local taxes and these states are displayed in this dropdown.

Name of Locality: Depending on what state you have chosen above, different options with appear here. Consult your local taxing authority for details.

Selected Filing Status: Displays the selected local tax to be edited.

Standard Deduction: Enter number of standard deductions for state 0 – 99

Exemptions: Enter number of exemptions for state 0 – 99

Prorate Percentage: For states that have multiple locals you can elect to have different percentages of that tax withheld. Default is to withhold 100% of this tax.

Related Topics