Pre-configured Additional Incomes Templates

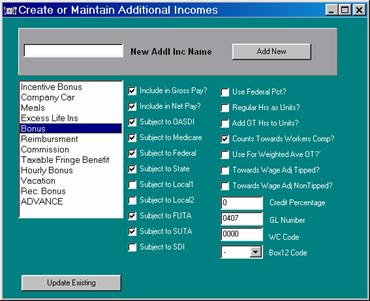

Go to Setup/Company/Additional Incomes

In this section, PayMaster already has 7 pre-configured Additional Incomes with the most common attributes selected.

To select one of the templates, click on the additional income (i.e. Bonus). Select or deselect the choices as seen above. The response to some of these questions may vary from state to state. Consult your accountant to make sure you respond correctly to each tax question.

|

|

Pre-configured Additional Incomes Templates

|

For new Additional Incomes, type the name of the Additional Income and click on "Add New" and select the attributes below. When finished, press "Update Existing".

Include in Gross Pay

Select if additional income is to be included in Gross Pay.

Include in Net Pay

Select if additional income is to be added to Net Pay. For example, a reimbursement that should be set up to NOT be in Gross but only in net.

Subject to OASDI

Select if additional income is subject to OASDI (Old Age, Survivors, and Disability Insurance or Social Security).

Subject to Medicare

Select if additional income is subject to Medicare Tax.

Subject to Federal

Select if additional income is subject to Federal Income Tax.

Subject to State

Select if additional income is subject to State Tax withholding.

Subject to Local1

Select if additional income is subject to Local Taxes if applies. This will apply to all local taxes that an employee might have.

In practice very few incomes should be marked non-taxable. Unselecting any of these taxes will not only prevent withholding of this tax but also will excluded that income from the selected taxable income.

Subject to Local2 (Depreciated)

Subject to FUTA

Select if additional income is subject to Federal Unemployment Tax.

Subject to SUTA

Select if additional income is subject to State Unemployment Tax.

Subject to SDI

Select if additional income is subject to State Disability Insurance.

Use Federal Pct (percent)

Select if additional income is to use the Supplemental Tax Rate.

Regular Hours as Units

Select if you want the additional income units to be equal to the number of regular units/hours worked.

Add OT Hours to Units

Select if you want the additional income units to include the overtime hours along with the regular hours.

Counts towards Workers Comp

Select if additional income is to be included in worker's compensation report.

Use for Weighted Ave OT

Select if additional income will figure in calculating Weighted Average Overtime. (For example: a non-discretionary bonus would be used toward Weighted Average, and therefore be selected, if overtime exists)

Toward Wage Adj Tipped

Select if additional income will be used in the Wage Adjustment calculation for tipped employees.

Toward Wage Adj Non Tipped

Select if additional income will be used in the Wage Adjustment calculation for non-tipped employees.

Credit Percentage

Enter the maximum percentage of the additional income that may be used to meet minimum wage.

GL Number

Enter General Ledger Account number for additional income.

WC Code

Enter Workmen's Compensation Code for the additional income if applicable.

Box 12 Code

Enter the appropriate code to be used on the W-2, Box 12. Refer to the instructions for Form W2 as these values are subject to change.

Click "Update Existing" to finish.

Related Topics