Now you are ready to set up your new company. Go to Start > Programs > PayMaster for Windows > PayMaster for Windows or just click on the newly created icon on your desktop.

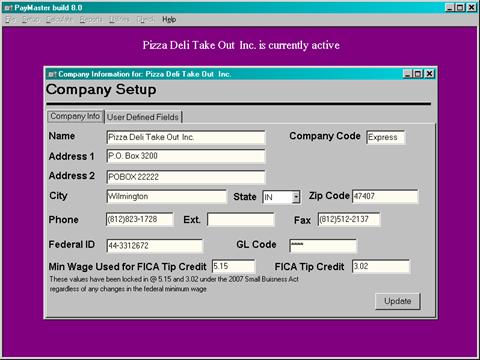

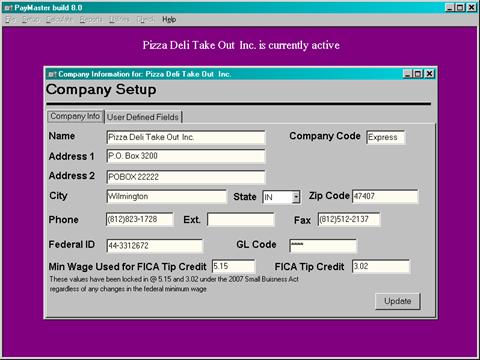

To enter information into your company: Go to Setup/ Company/Company. The "Company Code" is alpha numeric value up to 10 characters which can not be changed once company is created. It was created when entering "Add Company" function.

The "Minimum Wage Used for the FICA Tip Credit” has been locked in at 5.15, and the Federal Tip Credit is 3.02 as of this writing even though the Federal Minimum Wage may be higher. The software will use these values to calculate your year end Form 8846 (Federal Income Tax Credit for FICA Taxes You Pay on Employees' Tips)

Also note, the Federal ID is also called the "EIN", Employer's Identification Number.

Related Topics

Step by Step: PayMaster Setup

Additional Incomes

Deductions

FUTA/SUTA

GL Numbers (General Ledger)

401K

PA Local/SDI Setup