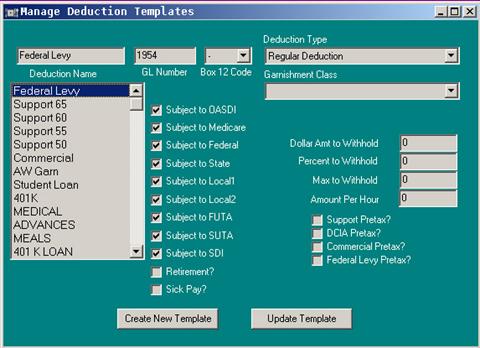

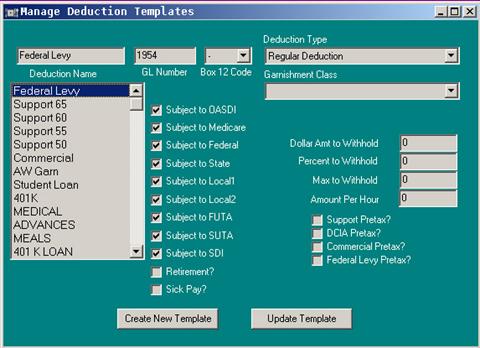

Go to Setup/Company/Deductions

In this section, PayMaster already has 11 pre-configured Deductions.

PayMaster Hospitality will take the deductions in a certain order. The first deductions taken will be:

Federal and State law also set caps for the amount that can be taken for all non-voluntary deductions. *The order noted above is how the software handles the order of deductions as required by law.

For new Deductions, type the name and click on "Create New Template" and select the attributes below. When finished, press "Update Existing".

The response to some of these questions may vary from state to state. Consult your accountant or plan provider to make sure you respond correctly to each tax question.

Subject to OASDI

Select if deduction is subject to OASDI taxes.

Subject to Medicare

Select if deduction is subject to Medicare.

Subject to Federal

Select if deduction is subject to Federal Taxes.

Subject to State

Select if deduction is subject to State Taxes.

Subject to Local1

Select if deduction is subject to Local Taxes. This will apply to all local taxes that an employee might have.

Subject to Local2 (Depreciated)

Subject to FUTA

Select if deduction is subject to FUTA (Federal Unemployment Tax).

Subject to SUTA

Select if deduction is subject to SUTA (State Unemployment Tax).

Subject to SDI

Select if deduction is subject to SDI (State Disability Insurance).

Retirement

Select if deduction is a "qualified retirement plan"

Sick Pay

Select if deduction is a "3rd Party Sick Plan".

Deduction Type

Select only one of the below deduction types:

Garnishment Class

This is how the deduction will be taken from the check.

If Child Support What is Max%

Enter the maximum percentage amount to be withheld

Dollar Amt to Withhold

Enter the dollar amount to be withheld

Percent to Withhold

Enter percent amount to be withheld

Max to Withhold

Enter the maximum dollar amount to be withheld

Amount Per Hour

Enter the dollar amount to deduct per hour

Pertaining to the following deductions, sometimes a court will order that a preexisting deduction will come before a new garnishment. If this is the case use these four questions to change the order of deductions. In this case, the order should be setup in the employee setup, deductions since it will vary from employee to employee rather than the global template.

Support Pretax?

Select if deduction to be taken before Support deduction.

DCIA Pretax?

Select if deduction to be taken before DCIA deduction.

Commercial Pretax?

Select if deduction to be taken before Commercial deduction.

Federal Levy Pretax?

Select if deduction to be taken before Federal Levy deduction.

Enter "Update Template" to finish.

Related Topics