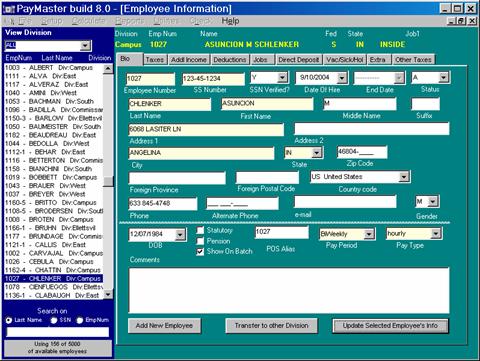

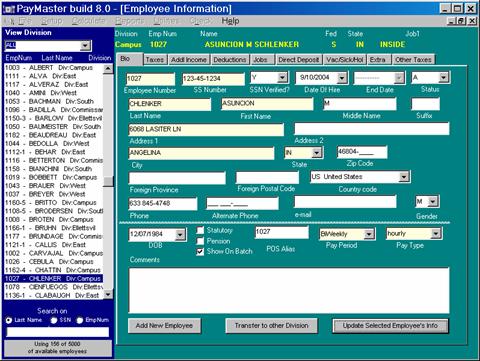

Under the "Bio" tab allows you to enter the basic information to identify each employee. The yellow highlighted fields are required fields.

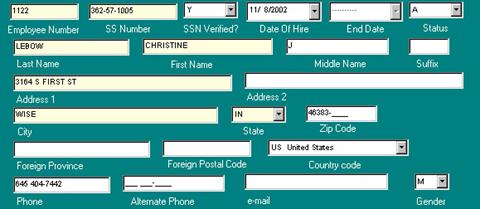

Employee Number: This value is used to uniquely identify each employee in your company. It can contain up to 12 numbers or letters.

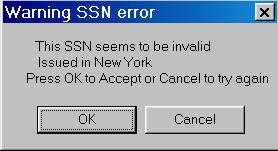

SS Number: Social Security Number from the employee’s W4. This field does a basic check to see if the number corresponds with the state. The SSA provides a list each month of valid SSN sequences and it is this data that PayMaster checks against. Auto-update users can receive an updated list quarterly. If the number does not follow the proper sequencing you will get a warning that this information may be incorrect. This is just a warning box as you are able to continue by accepting your input.

SSN Verified: Used for reporting.

Date of Hire/ End Date: Used to determine weeks worked / eligibility for 401k

Status: Active/Inactive or Deceased.

Last Name / First Name/ Middle Name Suffix: The name that will be used on each check and the year end W2.

Address 1, 2 /City /State/ Zip: The address that will be used on each check and the year end W2.

Phone/Alt Phone: Two phone numbers can be stored for contacting the employee.

Email: An email address can be stored for contacting the employee. Double-clicking on the email in this field will automatically bring up your properly configured email program.

Gender: Male or Female used for 401K, SSN Verification and some state reports.

![]()

DOB: Date of Birth used for 401K, SSN Verification and some state reports.

Statutory: Select if employee is considered a statutory employee. An employer should indicate on the worker's Form W-2 whether the worker is classified as a statutory employee. Statutory employees report their wages, income, and allowable expenses on Schedule C (or Schedule C-EZ), Form 1040. Statutory employees are not liable for self-employment tax because their employers must treat them as employees for social security tax purposes.

Pension: Select if the employee has a pension plan. Selecting this will allow pension to be checked off on the employees W2.

Show on Batch: Select if you the employee is to show in the Batch payroll screen. This is useful when an employee is still ‘active’ but is on a temporary leave of absence.

Note: When inactivating an employee be sure that this is unchecked as the employee will be still counted against your employee total.

POS Alias: This is the employee number assignment in the POS (Point of Sale) software. (i.e. Digital Dining, Time America Time Clocks, Micros, etc.) This number is used to identify the employee in both software programs for the interface. See the Setup/Time Labor/Pos Mapping

section to handle this in bulk instead of one by one.

Pay Period: Weekly/Biweekly/Monthly/Semimonthly. Used in the calculation of taxes.

Pay Type: Salary/Hourly/1099 NOTE: 1099 Pay Type: (not yet implemented) Select if employer is not responsible taking taxes. Year end the employee will receive a 1099-Misc form rather than a W2. The employee is responsible for calculating and paying the taxes.

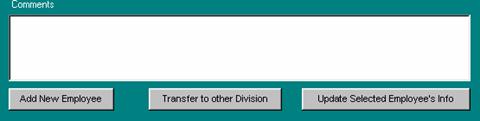

Comments: This is a text box for general comments. This section does not show on any reports.

Related Topics

Employee Setup

Add New Employee:

Transfer to other Division:

Update Selected Employee's Info:

Sorting, Filtering, Finding Employees:

Change Existing Employee Number: